[broadstreet zone=”51611″]

FRAMINGHAM – The 11-member Framingham City Council voted unanimously to put the Community Preservation Act on the November 2020 ballot, at its meeting last week.

The Community Preservation Act is a smart growth tool that helps communities preserve open space and historic sites, create affordable housing, and develop outdoor recreational facilities. Former Massachusetts Governor Paul Cellucci signed the act into law on September 14, 2000.

The Act allows communities to create a Community Preservation Fund for open space protection, historic preservation, affordable housing and outdoor recreation.

Money is raised through a taxpayers’ surcharge of not more than 3% of the tax levy against real property, and municipalities must adopt CPA by ballot referendum.

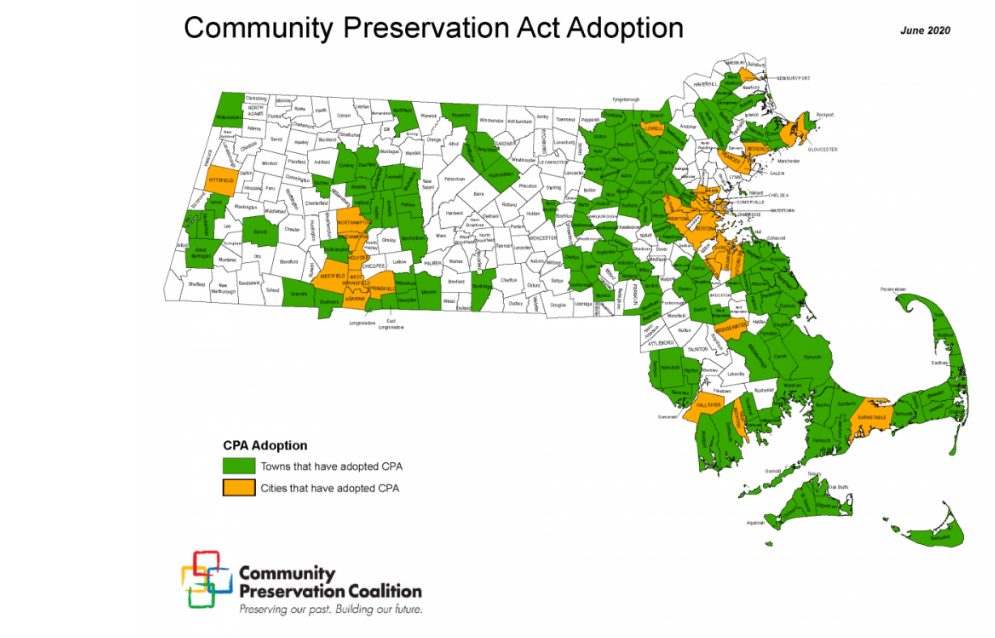

To date, 176 municipalities out of 351 in the Commonwealth of Massachusetts have adopted the Act.

[broadstreet zone=”80100″]

A 12-member Committee appointed by the 11-member City Council in November of 2019, recommended in its report to the City Council that the City adopt the Act, have a ballot question for voters in November 2020 to vote on creating the Act, and its 1% surcharge tax.

The 12-member group recommended the “City Council places a CPA ballot question on the November 2020 ballot for Framingham voters to consider. Under the requirements of CPA legislation, it is the voters that must decide if Framingham will adopt the Community Preservation Act. The responsibility of City Council, as the City’s legislative arm, is to put a CPA referendum on the ballot so that voters can make their wishes known.” wrote the study group chaired by Steve Weisman.

November 2020 would also be the presidential election.

The group is recommending a Community Preservation Act surcharge tax of 1% is assessed on property taxes paid by all classes of taxpayers – residential, commercial, and industrial.

The Group could have made a recommendation as high as 3%, but opted for the 1% surcharge tax.

For the referendum to be on the November ballot, the Secretary of the Commonwealth must receive the ballot question and summary from the City by September 4, 2020 and the City Solicitor must approve the ballot question and summary before the City submits it, the group wrote to the City Council.

The group wrote in its report “not adopting CPA has resulted in significant

missed opportunities.” Those opportunities, listed in the report included:

- Had Framingham adopted CPA as proposed in 2001, it could have had millions of dollars in state matching funds

- Without a CP Fund to support local projects, the City has lost significant open space and outdoor recreation opportunities [e.g., Millwood, Marist Fathers]

- Historic building updates were delayed and made more

expensive [e.g., Village Hall, Edgell Memorial Library] - Outdoor recreation projects were deferred [e.g., Farm Pond,

Pusan Road playground, Waushakum Pond bathhouse] - Unique historic landmarks are deteriorating and/or at risk

[e.g., Athenaeum Hall, Edgell Grove Cemetery

The working group in its report wrote “Framingham needs a dedicated CP Fund now more than ever.”

[broadstreet zone=”59984″]

The reasons included:

• Competition for City capital budgets makes it even more difficult to get “quality-of-life” projects funded

• More historic landmarks are at risk or require rehabilitation [e.g., Watson Place Fire Station, Postal Mile Markers (1768),Farm Pond Gatehouses]

• Development pressure on remaining open space is increasing [e.g., institutional holdings, agricultural land, MCI for Women]

• Demand for outdoor recreation space is growing

• Affordable, safe, healthy housing is becoming harder for seniors, renters, first-time home buyers to find

The group, in its report to the City Council, wrote “the benefits of adopting CPA will be significant for the City, while the cost to taxpayers will be modest.”

The study group recommended that the November 2020 ballot question include the following provisions:

- All properties paying property taxes shall pay the CPA surcharge

- The surcharge shall be one percent (1%) of property taxes

- Qualifying low- and moderate-income seniors and low-income residents shall be fully exempt from surcharge payment

- Residential, Commercial, and Industrial properties shall receive

an exemption for the first $100,000 of assessed property value - Surcharge assessment and collection shall begin in FY2022

The working group wrote to the City Council the timeline for a November 2020 ballot question is “doable but tight.”

If voters approve CPA on November 3, 2020, City Council then creates a Community Preservation Committee by ordinance.