In full transparency, the following is a press releasee submitted to SOURCE media through its business wire service.

***

[broadstreet zone=”53820″]

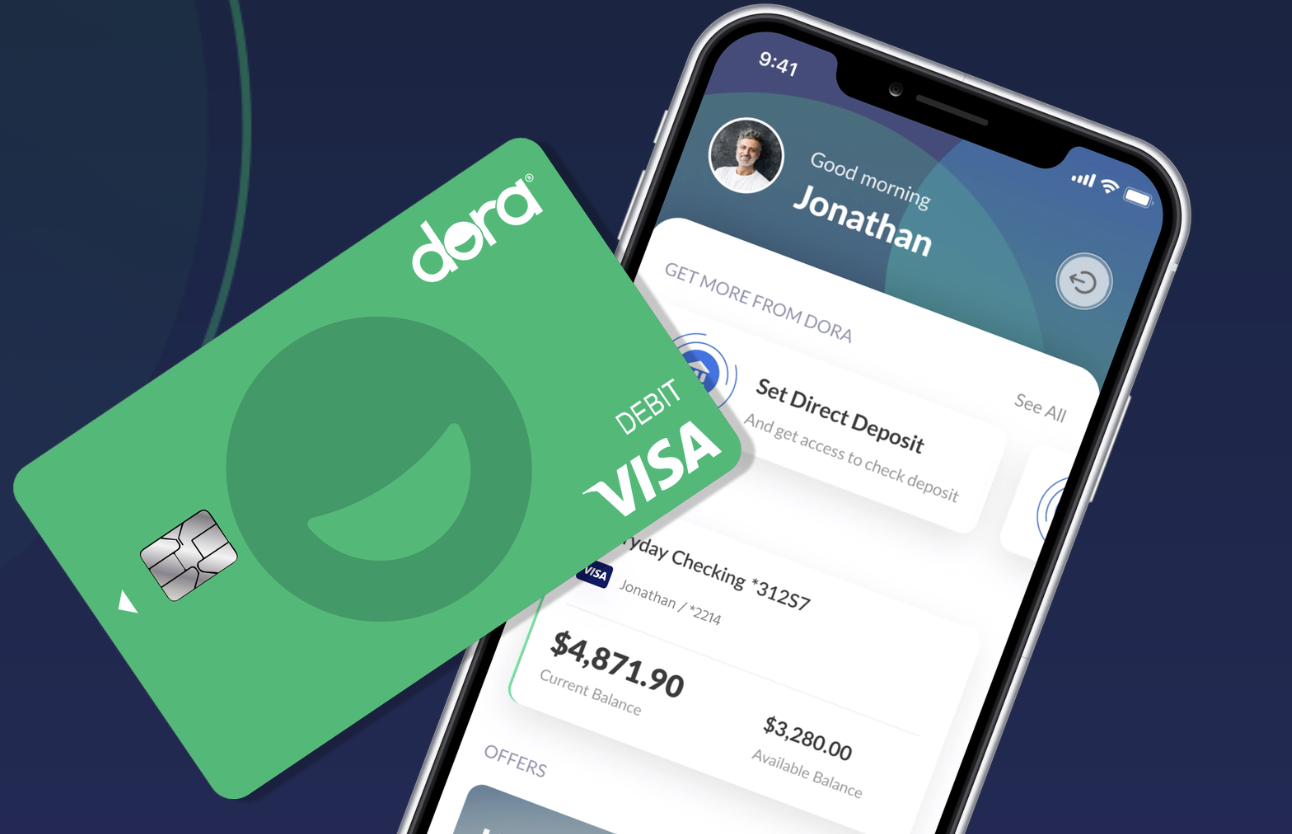

MARLBOROUGH – Dora Financial, a marketing and innovation CUSO (credit union service organization) powered by the credit union movement, announced the launch of its new feature, event-based financial coaching. Dora end users now have access to personal finance coaching at no cost through a new partnership with TrustPlus, a national financial health benefit powered by Neighborhood Trust Financial Partners.

“Dora exists to give the unbanked and underbanked access to fair financial services,” said Kristi Kenworthy, managing director, Dora. “Providing personalized financial coaching is the next logical step to helping nearly 50 million individuals, on their journey from financial exclusion to financial empowerment.”

This new feature enhances the Dora digital experience and adds a human element by enabling individuals to seamlessly connect with a TrustPlus Financial Coach who can help them navigate financial challenges.

Dora end users may access this complimentary service through their preferred communication channel – text, email, phone or skype, in both English and Spanish.

[broadstreet zone=”99032″]

“We are excited to partner with Dora Financial as they innovate into new technology and banking spaces. We can’t wait to measure how these innovations, when paired with our own technology and financial coaching services, will make us a powerful driver for financial wellness across the country,” added Christopher L. Starr, senior director of innovation at Neighborhood Trust Financial Partners, home of TrustPlus.

“Financial coaching services have been enabled by grant funds generously provided through Inclusiv’s partnership with Prudential.” Kenworthy continued. “We are excited to be able to deliver this level of financial coaching to our end users.”

[broadstreet zone=”59948″]

Dora Financial is the first CUSO (credit union service organization) neobank strategy powered by the credit union movement. Dora was founded by USALLIANCE Financial in 2021 to serve the 50 million Americans currently not participating in mainstream banking. Dedicated to financial inclusion, the Dora app features a fully bilingual digital banking experience. Dora is currently sponsored by five entities: Affinity Plus Federal Credit Union (Affinity Plus) headquartered in St. Paul, MN; Digital Federal Credit Union in Marlborough; Inclusiv in New York, NY; Service Federal Credit Union in Portsmouth, NH; and USALLIANCE Financial in Rye, NY.