[broadstreet zone=”59982″]

FRAMINGHAM – The 11-member Framingham City Council will vote tonight, November 22, on setting the tax rate, and deciding how much of a tax burden to give to commercial & industrial property owners and how much residential property owners should shoulder.

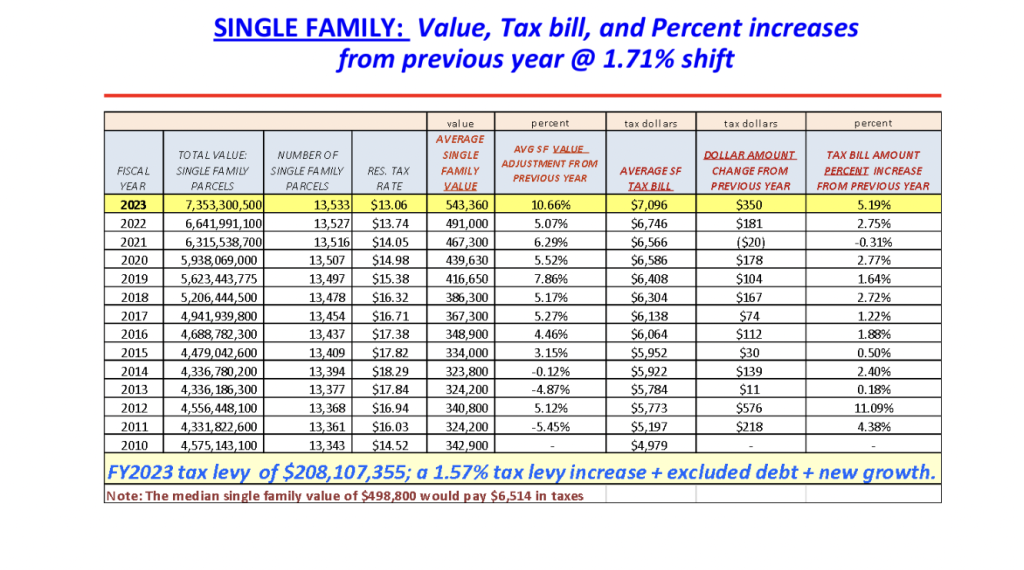

Homeowners could see a $350 increase in their property tax bill.

The main reason for the increase is a 10% increase in property values for residential properties.

The current residential tax rate is $13.74 per $1,000 valuation. The proposed rate is $13.06 per $1,000 valuation.

Even with the drop in the rate, homeowners will see an increase in their bill, due to the rise in real estate property values.

And that is with a split tax rate, in which businesses pay a higher rate than residential property owners.

[broadstreet zone=”59983″]

The legislative branch of City Government discussed the tax rate issue at its meeting last Tuesday, November 15, but could not make a decision. So tonight, November 22 a special virtual only-meeting for tonight, November 22 at 7 p.m.

The tax bill for the average residential property owner is proposed to increase by 5.19%.

That means the average tax bill would increase to about $7,096.

The median single family home in Framingham is $498,800. That tax bill would be about $6,500.

This would be the largest increase to homeowners in about a decade, as many are still struggling coming out of the pandemic with rising inflation.

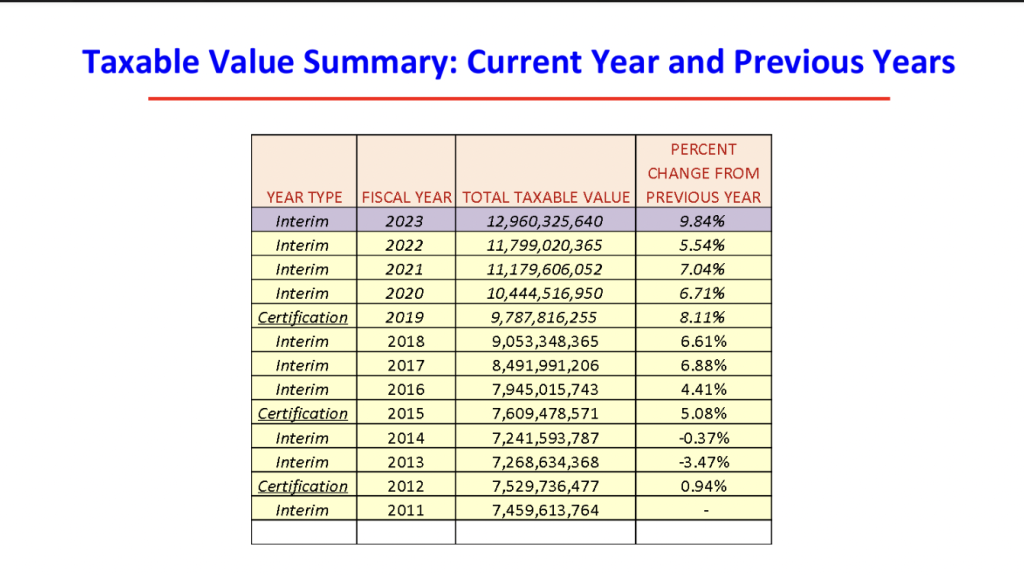

According to a presentation, residential properties increased by 10.2%

There are roughly 19,085 residential parcels in the City including, 13,533 single family homes and 3,315 residential condominiums.

Commercial properties increased by 8.7%. There are roughly 854 parcels.

Industrial class values increased by 7.7%. There are 108 industrial parcels in the City.

[broadstreet zone=”59984″]

City Council Finance Subcommittee Chair George P.King Jr. questioned how the Administration reached the $350 number and how much was related to the shift away from commercial & industrial property owners? How much was from the new Fuller Middle School?

City of Framingham Chief Financial Officer Louise Miller, in a memo to the 11 City Councilors, wrote there were 4 components to the average single-family tax bill increase:

First the $108 is attributable to the shift in the valuation between the residential and the commercial/industrial/personal property class, wrote Miller.

“The average single-family value for FY23 is $543,360. Assuming the same tax levy as FY22, the tax rate would be $12.614, which yields a tax bill of $6,854. The average tax bill would be $108 higher than in FY22, which was $6,746,” explained Miller in the memo.

Miller said that $110 is attributable to the increase in the tax levy. “The tax levy increase is 1.57%. This accounts for $110 of the increase in the single-

family tax bill.”

The tax levy is based on the budget Mayor Charlie Sisitsky proposed in Spring 2022, which the City Council approved in June 2022. That fiscal year started on July 1, 2022 and ends on June 30,2023.

[broadstreet zone=”54526″]

CFO Miller said “$32 is attributable to the increase in the excluded debt service for the Fuller Middle School project. The debt service for the Fuller Middle School is increasing by close to $1 million, which yields a $32 increase in the excluded debt portion of the tax bill.”

And finally Millers said $97 of the $350 proposed increase is attributable to new growth.

“Questions were raised as to why new growth would be a component of the increase in the single-family tax bill, since presumably, it should already be part of the levy. New growth was $4 million, which was approximately $.5 million higher than budgeted. This is new growth that is captured during the fiscal year and contributes $170 million to the City’s total valuation. Including new growth as part of the tax levy and then dividing it among all property values that have not contributed to the new growth may seem counterintuitive. However, this amount needs to be added to the total tax levy since the new growth taxes will be collected in FY23 and the increase in the property value needs to be added to the denominator,” wrote Miller in her memo to the City Councilors.

“This does not mean that the average residential property owner’s valuation is affected. For instance, if a residential property owner adds a garage to their home, the garage will be captured as new growth. This new growth does not affect the homeowner’s neighbors, even though it affects the City’s average single-family tax bill, because the new growth increased the total City valuation and the individual homeowner’s taxes, increasing the average tax bill,” wrote Miller.

“For FY23, actual new growth exceeded budget by $.5 million. The excess new growth has been allocated to the overlay account. This money would then be available to fund abatements. If it is not needed, then the Mayor may request that excess overlay be released to the City for further appropriation. If not appropriated after release, it would release to the undesignated fund balance and contribute to Free Cash. Given the City’s Free Cash position, it seems fiscally prudent to allocate the $.5 million to the overlay account. It could be used instead to reduce the tax levy,” wrote the CFO to the legislative branch.

[broadstreet zone=”59945″]

The CFO Miller will not attend tonight’s meeting but Chief Assessor Ed O’Neil is expected to attend.

To join the meeting:

ZOOM LINK: https://us02web.zoom.us/j/81957914340?pwd=MDdwK2VaMytPNGNzdFVCZEpJUHNqZz09

Passcode: 724015