In full transparency, the following is a press release submitted to SOURCE media.

***

[broadstreet zone=”51611″]

BOSTON – The COVID-19 pandemic has brought many changes to the economy, and one of the most profound impacts has been on the residential real estate market in the U.S.

For more than a year and a half, an unusual combination of factors has left would-be homebuyers navigating a highly competitive market with prices growing at an extremely rapid pace.

One of the major challenges has been supply.

Late in 2020, the inventory of homes for sale fell to all-time low levels, while supply chain challenges and a tight labor market have made it difficult for builders to complete new homes.

On the demand side, more homebuyers—many of them first- or second-time buyers of the Millennial generation—have been enticed to enter the market thanks to low mortgage rates and high savings and investment returns during the pandemic.

And while recent months have shown signs that the market may be cooling off, elevated prices may be the new normal in the residential market.

The S&P/Case-Shiller Home Price Index is one of the leading tools for tracking changes in U.S. home prices over time, and the growth in the index shows just how sharply home prices have risen. In August 2019, the percent change in home prices year-over-year dropped to 3.2%, the lowest rate of growth since the end of the Great Recession.

By August 2020, six months into the COVID-19 pandemic, the rate of growth had accelerated to 5.9%. And in August 2021, home prices were nearly 20% more expensive than they were the year before.

[broadstreet zone=”52093″]

|

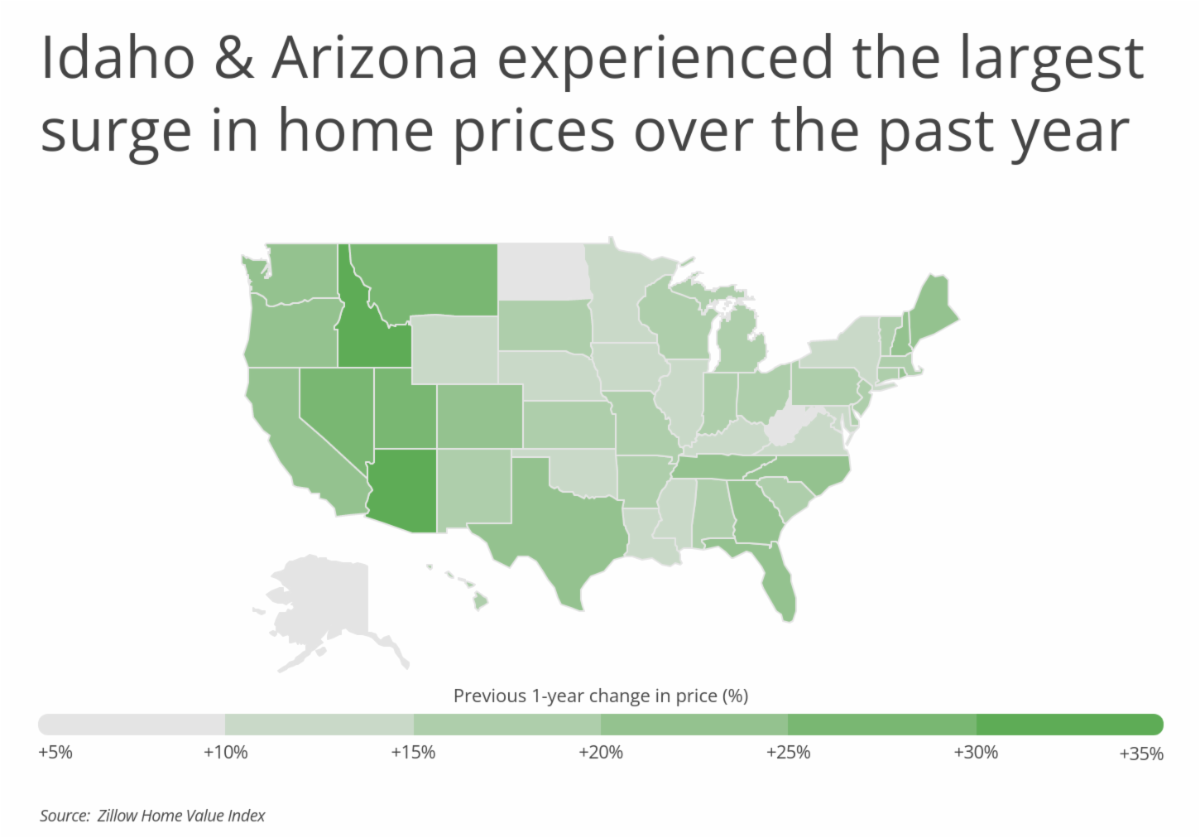

Rising home prices have been a nationwide phenomenon, but some markets have seen sharper increases than others. At the state level, many of the locations where prices have risen most rapidly are areas that had already been experiencing significant population growth, including Idaho, Arizona, and Utah.

These states were also popular destinations for people who moved during the pandemic, many of whom left expensive coastal states in search of more space and more affordable cost of living.

|

Housing markets at the local level show similar trends. Many of the counties with the highest increases in home prices were high-growth locales like Travis County, TX (Austin) and Maricopa County, AZ (Phoenix), which have emerged as more affordable alternatives to more expensive cities on the coasts.

The list of counties with the biggest home price increases also includes many suburban counties of major metro areas, like San Joaquin County, CA (east of the Bay Area), Snohomish County, WA (Seattle), and Gwinnett County, GA (Atlanta).

The data used in this analysis is from Zillow Group’s Zillow Home Value Index (ZHVI) and the U.S. Census Bureau’s American Community Survey.

To identify the states with the largest home price increases in 2021, researchers at Inspection Support Network calculated the percentage change in the ZHVI between October 2020 and October 2021. In the event of a tie, the state with the larger absolute price increase was ranked higher.

The analysis found that between October 2020 and October 2021, the year-over-year percent change in Massachusetts home prices was +17.3%.

Here is a summary of the data for Massachusetts:

- Previous 1-year change in price (%): +17.3%

- Previous 1-year change in price (absolute): +$79,418

- Median home price (October 2021): $539,007

- Median home price (October 2020): $459,589

For more information, a detailed methodology, and complete results, you can find the original report on Inspection Support Network’s website: https://www.inspectionsupport.com/resources/counties-with-the-largest-home-price-increases-in-2021/

[broadstreet zone=”59946″]