| In full transparency, the following is a press release *** |

[broadstreet zone=”59947″] |

BOSTON – Today, October 5, the Baker-Polito Administration announced the 2021 Community Investment Tax Credit (CITC) program allocations to 53 community development corporations (CDCs) and Community Service Organizations (CSOs) from across Massachusetts.

Nearly $9.7 million in tax credits will help organizations enhance their fundraising and organizational capacity, in support of their efforts to increase economic opportunity for low- and moderate-income residents.

Among the recipients was the South Middlesex Opportunity Council (SMOC) which received a $250,000 tax credit. The organization is based in Framingham.

[broadstreet zone=”59983″] |

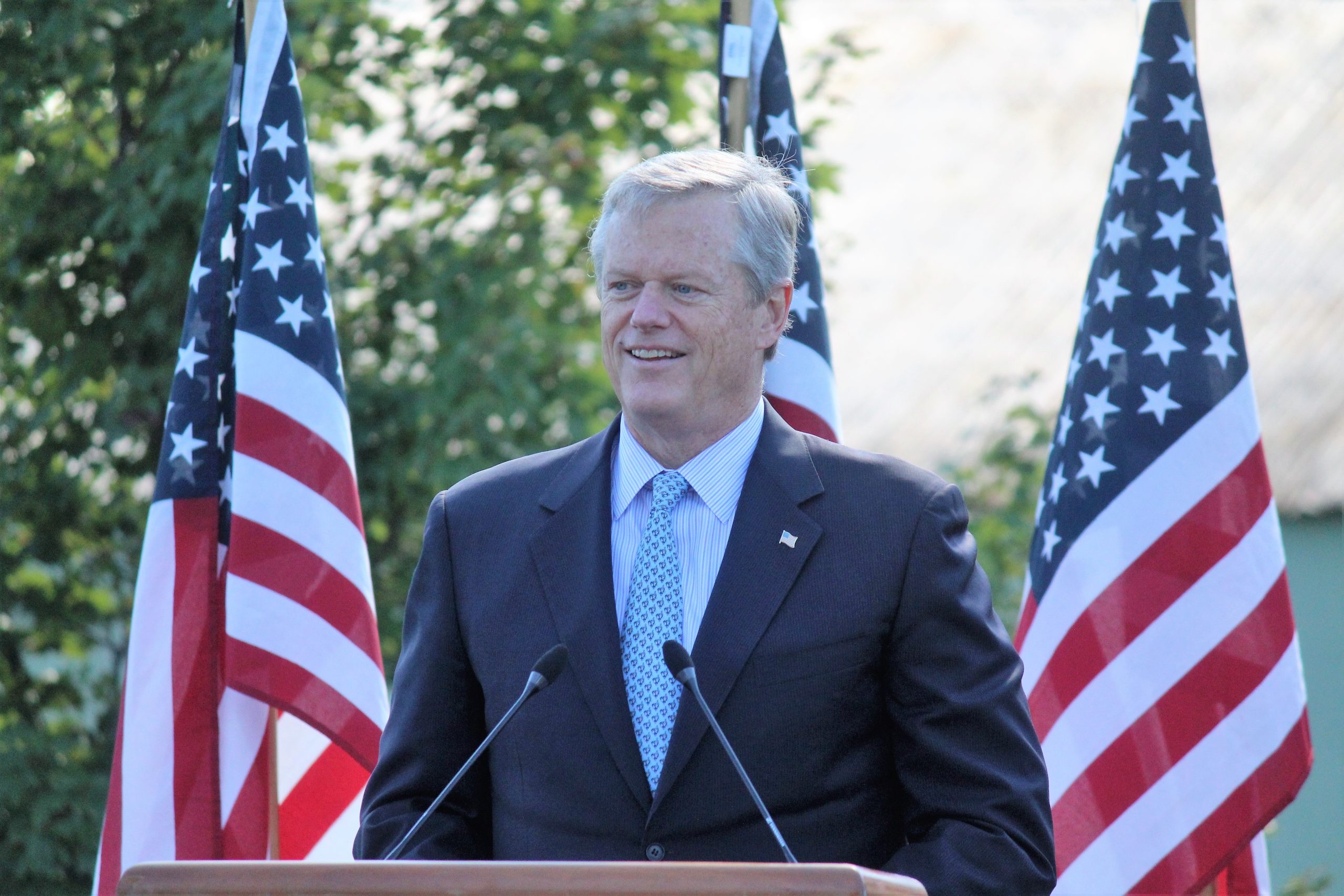

“Massachusetts is fortunate to have a large network of CDCs, keenly aware of community needs, providing a diverse array of services,” said Governor Charlie Baker. “We are proud to continue supporting the Community Investment Tax Credit program, which has enabled CDCs to raise and invest more than $75 million since it started.”

“The Commonwealth’s Community Development Corporations are leaders on the ground, creating tailored programing to fill gaps in their own neighborhoods, with financial literacy programs, small business support, first-time homebuyer education and youth services,” said Lt. Governor Karyn Polito. “Over the past year, CDCs were also vital partners in our statewide response to COVID-19, responding to local needs with direct aid and services and we are pleased to support our partners at CDCs across Massachusetts.”

Lt. Governor Karyn Polito and Housing and Economic Development Secretary Mike Kennealy were joined by a wide range of community development corporations and community service organizations in Revere for today’s announcement.

[broadstreet zone=”70107″] |

“Massachusetts Community Development Corporations have been ringing the alarm on our housing crisis for many years, and they have been building high-quality, affordable rental and homeownership opportunities to meet local demand. Throughout the pandemic, they have also been invaluable resources for our small businesses, especially those owned by people of color and serving disadvantaged communities,” said Massachusetts Housing and Economic Development Secretary Mike Kennealy. “The CITC Program enables CDCs to increase their fundraising, and in turn make greater investments in our communities to improve housing, provide assistance to small businesses, and enable neighborhoods to thrive.”

Community development is a critical part of DHCD’s mission, and our CDCs continue to be powerhouses of innovation and leadership in their regions. DHCD has long worked with CDCs to pilot new programs, fund financial literacy and first-time homebuyer programs, and develop affordable housing,” said Massachusetts Housing and Community Development Undersecretary Jennifer Maddox. “We are proud to continue supporting this high-impact program to help CDCs expand their reach.”

[broadstreet zone=”58610″] |

Community-based organizations have always been an important on-the-ground partner for the Commonwealth, and their efforts during the COVID-19 pandemic have been nothing short of heroic in supporting residents and small businesses. The network of Small Business Technical Assistance Providers helped businesses, especially those owned by people of color, individuals with low- and moderate-incomes, and other vulnerable demographic groups, navigate the reopening process, apply for the federal PPP loans, and access the more than $700 million awarded by the state through the Massachusetts Growth Capital Corporation (MGCC). These organizations will also continue to be key partners on neighborhood stabilization, affordable housing production, and closing the racial homeownership gap.

The CITC program allocates tax credits to CDCs that have adopted Community Investment Plans outlining their development strategies and goals. The credits are then offered by recipient CDCs in exchange for qualified donations, incentivizing the investments required to sustain the work of these organizations. Since the inception of the program in 2014, the Department of Housing and Community Development (DHCD) has allocated more than $42 million of these tax credits, yielding nearly $75 million in new investment for CDCs.

Certified CDCs provide community services, including financial literacy education, youth services, first-time homebuyer education and counseling, small business support, and other local economic and community development activities. Many CDCs also develop, preserve, and manage local affordable housing portfolios and receive funding or tax credit allocations through DHCD’s affordable housing development programs.

“We deeply appreciate the Baker-Polito Administration’s commitment to sustaining and growing this program which is spurring resident-led community development across the Commonwealth,” said Joe Kriesberg, President and CEO of the Massachusetts Community Development Corporations. This program provided CDCs with the flexible funding they needed to respond to the urgent and ever-changing needs of our communities during this awful pandemic. Now, with these awards, CDCs can leverage more private investment to fuel equitable recovery and growth.”

[broadstreet zone=”54526″] |

Earlier this summer, the Baker-Polito Administration and MGCC announced the award of $4 million to 45 non-profit technical assistance providers, many that are receiving CITC allocations, to continue working with small businesses and entrepreneurs from traditionally underserved communities to grow and expand their businesses.

Additionally, $14.7 million in grants were awarded to 15 organizations, including Community Teamwork, LISC Boston, Mill Cities Community Investments, and Southeast Asian Coalition of Central Massachusetts (SEACMA), under MGCC’s Community Development Financial Institution and Community Development Corporation’s (CDFI and CDC) Match Grant Program, which funds both lending and mini-grant programs for small businesses.

2021 CITC Tax Credit Allocations

ACEDONE*: $50,000

Act Lawrence: $50,000

Allston Brighton CDC: $200,000

Asian CDC: $170,000

CDC Southern Berkshire: $250,000

CEDC: $100,000

Chinatown Community Land Trust*: $50,000

Coalition for a Better Acre: $125,000

Codman Square Neighborhood Development Corp.: $200,000

Community Development Partnership: $250,000

Community Teamwork: $200,000

Dorchester Bay Economic Development Corp.: $150,000

Downtown Taunton: $75,000

Dudley Neighbors, Inc.: $150,000

Fenway CDC: $250,000

Groundwork Lawrence: $250,000

[broadstreet zone=”53820″]

Harborlight Community Partners: $250,000

Hilltown CDC: $150,000

Housing Assistance Corp. Cape Cod: $250,000

IBA: $150,000

Island Housing Trust: $250,000

JPNDC: $200,000

Just-A-Start: $250,000

Lawrence Community Works: $250,000

Lena Park: $100,000

LISC Boston: $250,000

[broadstreet zone=”56696″]

MACDC: $250,000

Madison Park CDC: $200,000

Main South CDC: $150,000

Mill Cities Community Investments: $250,000

NeighborWorks Housing Solutions: $150,000

New Vue Communities: $250,000

NOAH: $250,000

North Shore CDC: $250,000

Nuestra Comunidad: $200,000

One Holyoke: $200,000

Quaboag CDC: $250,000

Revitalize CDC: $200,000

SMOC: $250,000

Somerville CDC: $175,000

South Boston NDC: $50,000

South East Asian Coalition Central MA*: $50,000

Southwest Boston: $150,000

The Neighborhood Developers: $200,000

Urban Edge: $250,000

Valley CDC: $200,000

WATCH: $200,000

Way Finders: $175,000

Wellspring Cooperative: $150,000

WHALE: $175,000

Worcester Common Ground: $150,000

Worcester Community Housing: $175,000

Worcester East Side: $100,000

*Newly certified CDCs and first-time applicants